Retirement planning can be overwhelming, but it is essential for achieving financial independence. This guide will break down key strategies, investment options, and considerations to help you build a secure financial future.

Understanding Your Retirement Needs

Before diving into investment options, it’s crucial to determine your retirement goals. A common rule of the thumb is the 10/20 rule which encourages you to aim for 10 times your annual income for insurance needs and 20 times for retirement savings. For instance, if you earn $60,000 annually, you would ideally aim for a minimum $1.2 million saved for retirement, and $600,000 in insurance.

However, individual circumstances vary, and a personalized financial needs analysis can provide a more accurate picture.

Factors influencing retirement needs:

Different factors are crucial to achieve the best outcomes in retirement. Some of the factors to be considered include:

- Retirement Lifestyle: You need to decide the lifestyle you desire during your retirement.

- Healthcare costs. How will you pay for healthcare costs?

- Housing expenses. Where would you like to live during your retirement?

- Longevity Plan. You can decide the relationships that are important to your wellbeing, and plan to nurture the relationships. As well, what type of mobility do you desire in your golden years? All these should be included in your plan.

- Inflation. How would inflation affect your standard of life in retirement? You will do well by including this as a factor in your plan.

A comprehensive financial needs analysis can provide a clearer picture of your specific requirements.

The Building Blocks of Retirement Income

A comfortable retirement may include a blend of multiple income streams. A diversified approach to retirement income is essential to mitigate risks and maximize returns. Several income sources can contribute to your retirement nest egg. Let’s explore the key options available to Canadians:

Retirement Savings Vehicles

- RRSP (Registered Retirement Savings Plan): Offers tax deferral on contributions but you will pay taxes when you start to withdraw income from your RRSP.

- TFSA (Tax-Free Savings Account): Allows you to grow your savings tax-free, but contributions are not tax-deductible.

- FHSA (First Home Savings Account): Designed to help first-time homebuyers save for a down payment.

- Private Investments and Personal Savings: Additional sources of income, but often subject to taxes.

Government Programs

- CPP (Canada Pension Plan): A mandatory pension plan contributing to retirement income.

- OAS (Old Age Security): A taxable income source available to seniors.

- GIS (Guaranteed Income Supplement): A non-taxable benefit for low-income seniors.

Other income Streams

- Pensions: Employer-sponsored plans providing regular income in retirement.

- Annuities: Convert lump sums into regular payments.

- Stocks & Bonds: Offer potential growth but come with investment risks.

- Home Equity: Can be tapped through reverse mortgages or downsizing.

- Cash Value Life Insurance: Builds cash value over time. You should learn this carefully to understand how it can help safeguard your retirement income. Cash value in insurance policies can help safeguard your investments during market downturns during retirement or close to retirement.

The Impact of Taxes on Your Wealth

Understanding how taxes impact your investments is crucial for building long-term wealth. By strategically utilizing different investment accounts, you can optimize your financial growth and minimize your tax burden. Taxes can significantly impact your retirement savings. Understanding how different investment accounts are taxed is crucial.

Understanding Tax Implications on Investments

Canada offers a variety of investment accounts with distinct tax treatments. Let’s break down the key differences:

Tax Now Accounts

In these accounts, you pay taxes on investment income in the current year:

- Chequing and savings accounts: Interest earned on these accounts are taxable.

- GICs (Guaranteed Investment Certificates): Interest income on GICs are taxable.

- Stocks, mutual funds, and bonds: Capital gains (profits from selling investments) are generally taxed, while dividends may have preferential tax rates.

- Non-registered investments: Income and capital gains are subject to taxes.

Tax

Now

Chequing

Savings

GIC

Stock

Mutual Fund

Bond

Interest Income

Non-Registered Investments

Tax

Later

RRSP

LIRA

RIF

Tax Advantaged

TFSA

FHSA

RESP

Life Insurance

Individual Critical Illness Insurance

Individual Disability Insurance

Health Insurance

Primary Residence

RDSP

Tax Later Accounts

These accounts defer taxes until you withdraw the money.

- RRSP (Registered Retirement Savings Plan): Contributions are tax-deductible, and growth is tax-deferred. However, withdrawals are taxed as income.

- LIRA (Locked-In Retirement Income Fund): Similar to RRSPs, but typically used to transfer funds from a pension plan.

- RIF (Retirement Income Fund): Mandatory withdrawals start at age 71, and withdrawals are taxed as income.

Tax-Advantaged Accounts

These accounts offer various tax benefits.

- TFSA (Tax-Free Savings Account): Both contributions and investment growth are tax-free.

- FHSA (First Home Savings Account): Contributions are tax-deductible, and withdrawals for a first home purchase are tax-free.

- RESP (Registered Education Savings Plan): A parent or a subscriber contributes money into a child’s RESP account. The RESP account would also be boosted by grants from the Government of Canada. Withdrawal are taxable to the student, but because of the progressive taxation in Canada, the taxes incurred are usually negligible.

- Cash Value Life insurance: Investment growth in cash value life insurance can benefit from tax-advantages. This is a complex financial product, hence you should seek the advise of a knowledgeable insurance broker to see if this product could be beneficial for you.

- Disability and critical illness insurance.

- Health insurance.

- Primary residence: May be exempt from capital gains tax on sale.

- RDSP (Registered Disability Savings Plan): Government grants match contributions, and income earned is tax-sheltered.

Maximizing Your After-Tax Returns

To optimize your investment returns and minimize your tax bill.

- Understand your tax bracket: Your marginal tax rate determines the impact of taxes on your investment income.

- Diversify your investments: Spread your money across different account types to balance tax implications and risk.

- Consider tax-loss harvesting: Offset capital gains with capital losses to reduce your tax bill.

- Seek professional advice: A financial advisor can help you create a tailored tax-efficient investment strategy.

By carefully considering the tax implications of different investment accounts, you can make informed decisions to grow your wealth and achieve your financial goals.

Would you like to learn more about specific investment strategies or tax-advantaged investment options?

Other Factors

A comprehensive financial plan should consider factors like:

- Risk tolerance: Your comfort level with investment fluctuations.

- Time horizon: How long you have until retirement.

- Income goals: Desired retirement lifestyle and expenses.

- Tax implications: Optimizing your tax efficiency.

- Estate planning: Ensuring your assets are distributed according to your wishes.

Remember, seeking advice from a qualified financial advisor can help you create a tailored retirement plan that aligns with your specific goals and circumstances.

Starting to Invest Early Matters

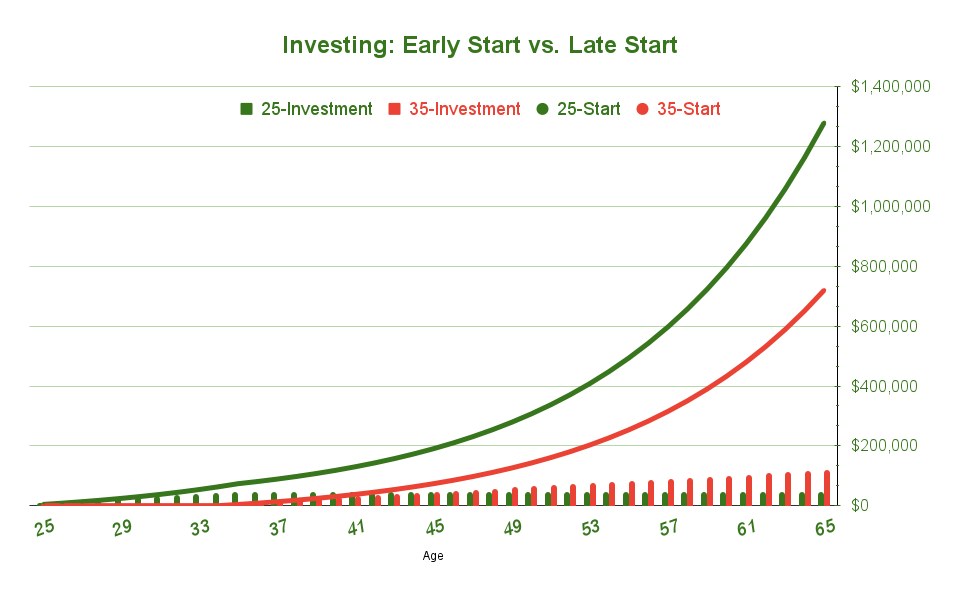

The earlier you start investing, the more time your money has to grow. This fundamental principle is the cornerstone of wealth building. Let’s illustrate this with a concrete example.

Imagine two individuals, Alex and Ben, invested $300 monthly at 8% annual compounding.

- Alex starts investing at age 25. He diligently invests $3,600 for eleven years (a total of $39,600), until he turns 35, and stops.

- Ben on the other hand waited till he turned 35 before he started investing. He had to invest for a much longer period of 31 years, i.e., until he retired at 65.

The Impact of Time

The chart above shows that Alex would have more than $1.2 million at 65, whereas Ben will have about $700,000.

Because of compound interest, by the time Alex reaches 65, he would have benefited from a 40 years compounding and growth, whereas Ben only had 31 years to grow his investments. While they both contributed the same amount annually, the difference in their final balances is striking.

Ben had to invest a total of $111,600, which is $72,000 more than Alex’s $39,600 investment, and still had much less at 65 than Alex. While Ben’s contributions are consistent, the head start Alex had gives him a substantial advantage.

Compound interest and time were the factors that helped Alex’s investment to perform much better than Ben’s.

Over time, the compound interests create a snowball effect, accelerating growth. As well, the longer your money is invested, the more opportunities it has to compound. Even small differences in starting age can lead to substantial disparities in final balances.

While it may seem daunting to begin, even small, consistent contributions can yield remarkable results over time. Remember, the best time to start investing was yesterday. The second best time is today.

Using the Financial Wealth Formula

Financial wealth is influenced by money, time, rate of return, inflation, and taxes. The financial wealth formula provides a basic framework for understanding the factors that influence your overall financial health. By maximizing your income, investing wisely, and minimizing taxes, you can increase your financial wealth over time.

Money

+ Time

+/- Rate of Return

– Inflation

– Taxes

How the Formula Works

The financial wealth formula illustrates the interplay of various factors that influence your financial well-being. To maximize financial wealth:

- Increase your initial money: Save more, earn more, or seek additional income streams.

- Extend your investment time horizon: Start investing early and maintain a long-term perspective.

- Optimize your rate of return: Choose investments with the potential for higher returns while considering risk.

- Minimize the impact of inflation: Invest in assets that would outpace inflation.

- Effectively manage taxes: Utilize tax-advantaged investment accounts and strategies.

By carefully considering these components, you can make informed financial decisions and work towards building long-term wealth.

Conclusion

Building financial wealth is a journey that requires careful planning and strategic decisions. By understanding the interplay of money, time, rate of return, inflation, and taxes, you can make informed choices to achieve your financial goals. Remember, the earlier you start investing, the more time your money has to grow.

While there’s no one-size-fits-all approach to financial planning, this guide provides a solid foundation. By combining knowledge with disciplined action, you can increase your chances of securing a comfortable financial future.

Ready to take the next step?

Schedule a free consultation with our financial advisors to create a personalized plan tailored to your specific goals. Let’s work together to build a brighter financial future for you and your family.